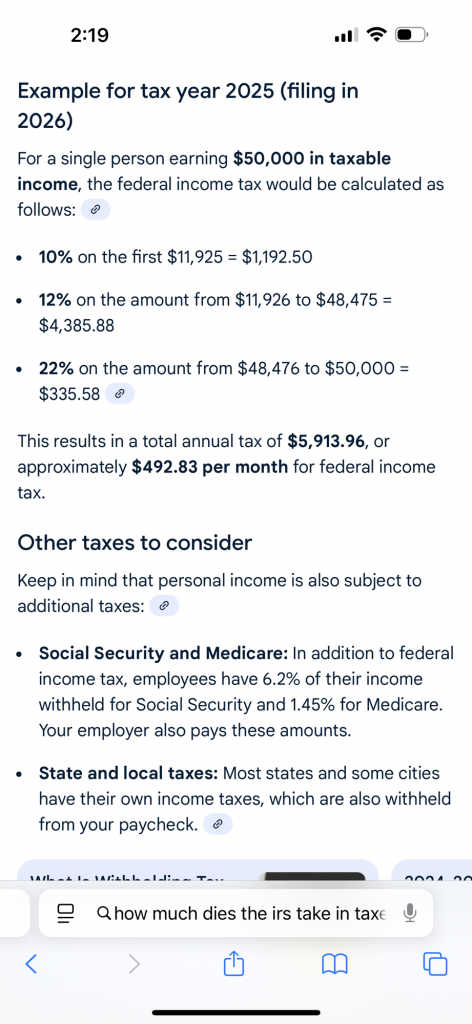

I guess I would try to stay below the $48,000 income level!!!

Anyway why does it say 22% of 50,000 is $335.58?? It’s $11,000 in taxes.

12% of $48,000 is $5,760 in taxes to be paid to the IRS.

An income of 50,000 – 11,000 in taxes (at 22%)= $39,000 take home (net)

An income of 48,000 – 5,760 in taxes (at 12%)= $42,240 take home (net)

I guess a raise would not be beneficial. I also read that if you have rental property income they will tax it at the same amount as personal W2 income, 10, 12, and 22% !

What do our income taxes go for?

I read online that the 48,475 changed to 47 thousand something. I saw that it was lowered by about 1,000.00

Leave a Reply