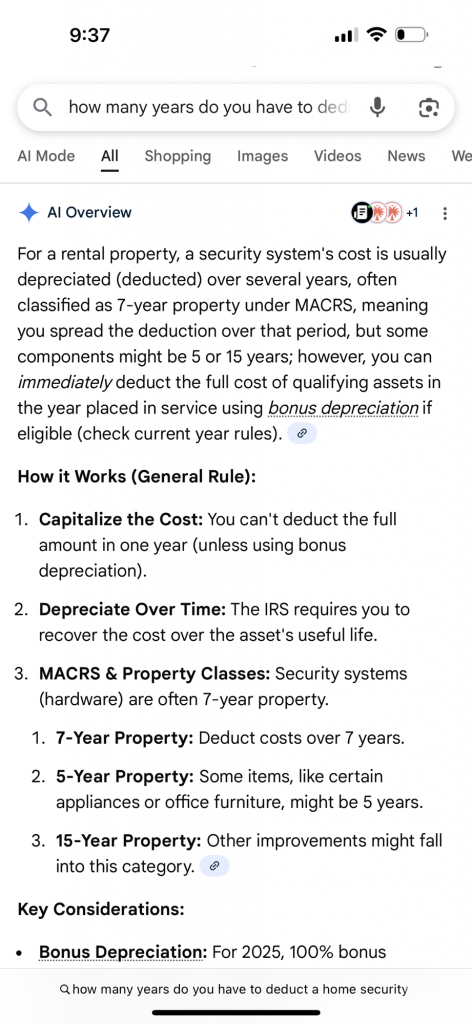

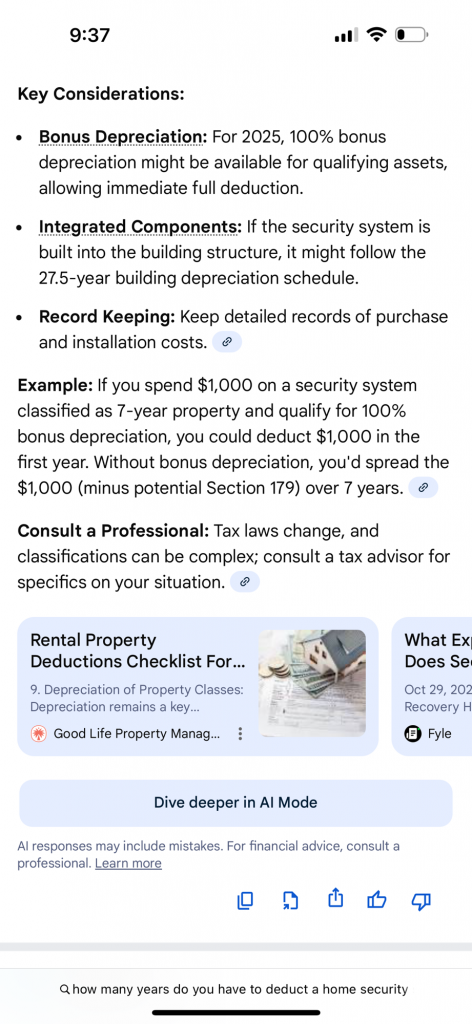

I read that if you have a security system for your home and you rent your home then you can deduct it off of your taxes. It is super confusing how the IRS words the stipulations though..,

I am going with the bonus depreciation option. I paid my security system by Vivint off last year, finally. Except that they keep saying that I owe them money! BUT I over paid them by a little more than $500. I proved to them that I paid that and they sent me to some money servicer but it didn’t seem like a collection agency. I proved to them as well but I think they refuse to believe me for some reason. But I have the original loan document with the original amount and looked at all of my bank statements and yes I over paid them. So I am going to deduct the full amount since I became the owner of that equipment last year when I paid it off using the bonus depreciation option. I don’t think that I will have to name that on turbo tax but if I get audited I guess I would have to figure that out then. Also my income is landlord income, not w-2 income or I-9 income. If you have these incomes and you itemize your deductions, then that could be a deduction for you.

Leave a Reply